With almost two dozen patents in the pipeline involving lithium anode production, Li-Metal Corp. is positioning itself as a materials supplier for companies which will produce the batteries of the future.

Li-Metal (LIM) is developing and commercializing technology aimed at the successors to the lithium-ion battery. That includes solid state, liquid electrolyte, lithium sulphur batteries and more.

Anodes are one of two electrodes that make up a battery, including those in electric vehicles (EVs). In traditional anode production, chunks of lithium are flattened into a very thin foil. Li-Metal uses what it refers to as deposition technology, using lithium carbonate as its main input.

“Instead of squeezing the lithium down to a thin material, we actually build it up on a substrate,” said Maciej Jastrzebski, Li-Metal’s CEO and co-founder. “We can go from as thin as almost zero up to . . . the typical thickness is five, 10 and 20 microns of lithium on the surface of this substrate.”

This results in less lithium per metre of anode than in traditional production.

The product has the same storage capacity, but is more cost efficient and allows for more cells to be used in the battery. In short, this will make for “lighter EVs that can go farther.”

According to Jastrzebski, Li-Metal has about 22 patents in various stages of development and approval. He expects some of them to be granted within the next year.

Li-Metal technology

Another difference in Li-Metal’s process is in the use of lithium carbonate as a feedstock instead of lithium chloride – which means no chlorine gas is produced as a byproduct.

Since lithium carbonate is already used in lithium-ion batteries, “What that allows us to do is to bolt on the conventional lithium ion battery supply chain onto the next generation of battery supply chain,” Jastrzebski said.

This cleaner process is also more simple, and that is what gives Li-Metal its edge.

“Having our material in some of the first commercial EV next-generation batteries, that’s the animating vision for us,” Jastrzebski explained, “because we know that once we get there, the rest of the pieces start to fall into place.”

He also sees other applications for the technology including aviation, where increased energy density per pound of weight is paramount.

Li-Cycle and Li-Metal

Li-Metal was born from a series of lunch meetings in late 2018 between Jastrzebski and Tim Johnston, the founder of the Mississauga-based lithium battery recycler Li-Cycle Holdings Corp.

In an April interview with SustainableBiz, Johnston called Li-Cycle’s recycling technology the “missing link in the battery supply chain.”

Both had previously worked at engineering consulting firm Hatch Ltd. Johnston left about a year before Jastrzebski to start Li-Cycle (LICY-N).

As Jastrzebski remembers, it was through Johnston’s work with battery companies, which all spoke about the need for a metallic lithium supply, that they both realized there would be demand for this material as new technologies emerge.

“I took an evenings and weekends type of effort for about three months, just building models and designing equipment just to get our heads around what this new process might look like,” Jastrzebski said.

Initially, there were issues in determining how to scale lithium anodes in foil form until the company’s proof-of-concept materials were well received by investors. By late 2020 that reception formed a significant part of Li-Metal’s decision to go public.

Li-Metal’s agreements and developments

In November 2021, Li-Metal’s anode and lithium metal production facility in Markham, Ont. opened. Located near the team’s Toronto headquarters, where most of the technical team is based, the goal is to run increasingly ambitious piloting this year to prove the lithium metal production is practical and economical.

Li-Metal plans to develop full-scale anode plant, initially capable of producing between 100 to 300 MWh of anode materials per year, in 2023. However, a location has not yet been announced.

In January Li-Metal’s Rochester, N.Y. roll-to-roll pilot plant was commissioned and completed its first batch of lithium metal anode product. Were it to run 24/7, it’s capacity would be “tens of thousands of metres per annum,” according to Jastrzebski. The following month, it shipped its first batch of product.

The company predicts it will reach full commercial capacity by 2025, by which point it wants to be at a “gigwatt-plus scale” of production.

“The short term goal is to continue to feed samples into the marketplace in support of our battery development partners,” Jastrzebski said, “to demonstrate the production of metallic lithium from our process on an industrially relevant scale and to advance the development of our demo scale and production facilities.”

In February Li-Metal signed a development and commercialization agreement with Blue Solutions, a producer of solid-state lithium metal batteries. The aim is to use metallic lithium anodes in Blue Solutions’ Lithium-Metal-Polymer batteries. In April, it received a $1.9-million grant from Next Generation Manufacturing Canada, as part of the $5.1-million development project.

The agreement was born out of initial sampling of Li-Metal’s technology.

“What we’re doing is we’re working to develop an ultra-thin, metallic lithium anode that can then go into their next-generation battery technologies, their follow-up technologies and potentially commercially deployed battery cells as well,” Jastrzebski said.

Blue Solutions, a subsidiary of Bolloré SE, is based in France and in Montreal and will collaborate with Li-Metal on the project.

Li-Metal nearing production of lithium metal anode material

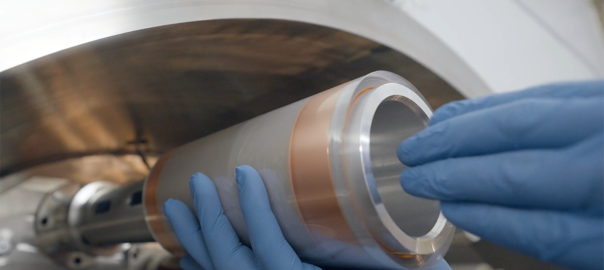

Li-Metal, a developer of lithium metal anodes and other battery technologies, has released an operational update for its roll-to-roll anode pilot plant in Rochester, New York. Since its commissioning earlier this year, the facility has been ramping up production of its lithium metal anode sample materials using Li-Metal’s roll-to-roll physical vapor deposition (PVD) process.

This year, the facility has produced more than 3,000 meters of sample material for both internal and customer use. The plant can produce anode products with lithium thickness between 3 and 25 micrometers, and the company continues to customize its offerings to meet the unique needs of prospective customers.

Li-Metal has completed proof-of-concept testing of silicon anode pre-lithiation using its PVD equipment. Once it expands to commercial-scale pre-lithiation, Li-Metal says it will be able to serve a broader customer base with multiple next-generation battery anode technologies, significantly expanding the addressable market for its offerings.

“Silicon anodes are an exciting next-generation battery technology that is being commercialized in parallel with lithium metal-based batteries,” said Dr. Jonathan Goodman, Li-Metal’s Chief Scientist. “A key challenge with many silicon anodes is that they experience a significant loss of battery capacity in the first charge-discharge cycle. Our silicon pre-lithiation work holds substantial promise as a cost-effective, performance-enhancing technology to overcome this challenge.”

“Our US pilot plant continues to hit key benchmarks and technical milestones,” said Maciej Jastrzebski, co-founder and CEO of Li-Metal. “The process productivity increases we have achieved this year play a big part in determining production economics. We have demonstrated high-rate deposition, and to our knowledge, we are operating the highest-intensity PVD lithium deposition process in the world.”

Li-Metal recently completed a scoping study for the development and build-out of a small commercial-scale anode production facility. The envisioned plant will demonstrate a PVD lithium anode production line at full scale, while supplying up to a million meters per year (approximately 200-250 MWh) of large-format anodes for advanced product qualification and early-stage production.

“As our customers increase the scale of piloting activities for their next-generation batteries, we are advancing our scale-up efforts in lockstep with demand so that we are in a leading position to support the advancement of these technologies,” said Jastrzebski. “In addition to maturing our processes, the team is focused over the coming year on securing partnerships and material orders to secure offtake for the Anode Demo Plant.”

Transport industry leaders share 2023 predictions for decarbonization

In the race to net zero, what’s in store for transportation and mobility this year?

From top left: Ingrid Irigoyen, Joshua Aviv, Barbara Humpton, David S. Kim, Nate Springer, Daniel Weissland, Ajay Kochhar, Mike Roeth, Chris Baker, Paul Augustine, Rohini Sengupta, Bill Cawein, Josh Green, Colin Gounden, Riona Armesmith, Stacy Noblet, Maciej Jastrzebski, Pam Fletcher, Gregory Davis, Monica Araya, Fredrika Klarén, Apoorv Bhargava, Blain Newton, Dr. Shelley Francis

The starting pistol has fired, and 2023 has officially begun. However, the race to decarbonize transport and the many facets of each subsector such as road vehicles, aviation and maritime shipping has been going on for years. So, in a way, it may be better to think of 2023 as the passing of the baton from 2022, in the broader race to net zero. However, unlike a relay race in which one runner from a team passes the baton to the next runner, industry leaders must keep running, together, farther and faster than ever before if we are to win the race.

Following that metaphor in the race to net zero, what’s in store for 2023? Personally, I think 2023 will be the year of manufacturing — where much of the focus on electrification will shift from making commitments and announcements for releasing new EVs to focusing on growing manufacturing capacity to act on existing commitments for new EV models. Additionally, automotive companies will strive to lower EV production costs to counteract simmering battery price decline. Lastly, as it pertains to the U.S., automakers will continue sprinting to reshore battery manufacturing and supply chains driven by legislation adopted in 2022, which will continue to cause and even increase geopolitical trade tensions between the U.S. and its allies as well as with multinational companies.

I decided to ask some of our fellow runners what their predictions are for 2023 across some of the highest-emitting areas of transport. Their responses have been lightly edited for length and clarity.

Public transit

David S. Kim, Senior Vice President and Principal, National Transportation Policy and Multimodal Strategy, WSP

I believe 2023 will include the following: (1) despite stepped up efforts by cities to implement safety measures, fatalities and serious injuries among vulnerable road users will continue to rise in 2023, (2) sales of e-bikes and zero emission vehicles will continue to increase and (3) transit ridership throughout the United States will gradually improve.

Aviation

Pam Fletcher, Chief Sustainability Officer, Delta Air Lines

In 2023, we will see an influx of cross-industry and stakeholder collaboration to drive real actions toward net zero emissions by 2050. This is a top priority for Delta in the year ahead as we double down on the power of our people to accelerate change in areas we control, drive demand signals for mid-term solutions like SAF and convene innovators to advance tech that can truly decarbonize aviation.

Rohini Sengupta, Director, Sustainability and Decarbonization, United Airlines

While I’m typically not in the business of prediction when it comes to decarbonization work, I feel an overwhelming sense of optimism going into 2023. For air transport, I believe the upcoming year will show acceleration in the scale of sustainable aviation fuel (SAF), from first fuels through new commercial pathways to increased production — I think we’ll hear about more SAF projects than ever before! I also think we’ll really get to see what policy’s support can mean to advance clean technologies: With the passing of the Inflation Reduction Act, I believe 2023 will bring an unprecedented level of investment and design around projects in clean energy, clean hydrogen and carbon capture (not to mention the credits for SAF). All in all, thrilled to meet 2023 with open arms!

Riona Armesmith, Chief Technology Officer at magniX

I anticipate that we will be hearing more about alternative and green fuel production, such as hydrogen, ammonia and potentially biofuels. We’ll hear about their use cases across transport sectors, their production by electrolysis and green energy and how to transport the fuel around globally or produce it onsite, close to the point of use. I also think we’re going to see more battery technologies maturing, with comparisons of the relative merits of green fuel combustion versus fuel cells on the use case side.

Gregory Davis, President and CEO, Eviation Aircraft

2023 will be the year of the electric airplane. This technology is going to be a market maker. We are going to see major air carriers and new entrants announce their adoption of zero-emission aircraft for regional air mobility.

Blain Newton, Chief Operating Officer, BETA Technologies

In the past few years we’ve seen operators make purchase commitments around sustainability and innovation, but now that we’re seeing technical and regulatory progress across the sector, it’s about turning those commitments into reality. Operators are bought in on these transformative technologies and they want to deploy them as soon as possible. In 2023, I think we’ll see operators focused on doing the work required to really integrate these technologies into their business, from updating their networks to implementing infrastructure and figuring out where exactly this technology plugs in.

Road vehicles

Mike Roeth, Executive Director, North American Council for Freight Efficiency

I predict that 2023 will be the year where vans and truck builders, Classes 3-8, will deliver and are prepared to ramp up truck production, actually faster than the required charging infrastructure can be created to match the truck deliveries. More benefits and challenges will emerge as the many organizations deploying these trucks will get more deeply into the details. Sustainability and regulations will increase providing the certainty of action and in determining the correct mix of technologies for long-haul trucking.

Paul Augustine, Head of Sustainability, Lyft

2023 will be a year of massive growth in vehicle electrification as the groundwork that was laid in 2022 — historic public policies and ambitious private sector investments — take hold and bear fruit. To meet the urgent threat of climate change, the new year must be focused on execution and implementation of transformative projects and programs within the transportation system.

Dr. Shelley Francis, Co-Founder and Managing Partner, EVNoire

We have been propelled forward in accelerating multimodal EV adoption through a transformational investment and commitment from the federal government, utilities, cities, the philanthropic community and more to accelerate equitable electrification across the corners of the 50 states. By December 2023, 50 percent of the 100 largest U.S. cities will make a commitment to electrifying their fleets e.g., transit, micromobility; we will see a 40 percent increase (compared to 2020) in investment in the workforce and manufacturing sector throughout the Southeast region in both rural and urban communities as this region sits at the nexus of transportation electrification and manufacturing. And finally, with EV adoption rates in the U.S. doubling from 2020 rates, consumers will have close to 150 EV models to purchase/lease.

Chris Baker, Head of Enel X Way North America

2023 will represent the biggest year in unlocking public charging infrastructure funds, with the National Electric Vehicle Incentive program and Inflation Reduction Act kicking off. As more EV makes and models come to market, the prospect of ensuring accessible EV infrastructure for all is ramping up, as is demand for public charging. The future is most definitely electric.

Monica Araya, Distinguished Fellow, ClimateWorks Foundation

I predict (1) new competition around industrial policies and investment incentives to promote domestic vehicle and battery manufacturing, (2) trade tensions and geopolitics reconfiguring supply chains and (3) momentum in new segments from e-bikes and electric ferries to e-buses and clean trucking.

Barbara Humpton, President and CEO, Siemens Corp.

We’re at a moment where we have the technology we need to decarbonize industry and infrastructure. The question is, how can we deploy it faster, and at scale? From the building of a national EV charging infrastructure network, to the transformation of rail, to the reinvention of American manufacturing, I think we’re going to see the answer to this question really take shape in 2023, with cross-sector partnerships and ecosystems driving progress forward in a big way. Working together, I’m optimistic we will accelerate our clean energy future faster than we could have ever imagined.

Fredrika Klarén, Head of Sustainability, Polestar

I think the disconnect between the expectations that consumers and stakeholders have on the automotive industry to transition, and the industry’s current capacity will become even clearer. We are not where we need to be in terms of scale and financial investment for low-carbon and net-zero solutions. With EVs, we have an existing, scalable climate solution, and we at Polestar will continue to push for collective action in the car industry to secure that we do our bit in bending the curve in time.

Josh Green, Founder and CEO, Inspiration Mobility

2023 will be the year that EV adoption by commercial fleets becomes the norm. With looming corporate climate commitment deadlines and a step-change in new EV models available at different price points, commercial fleets will move to take advantage of the cost and sustainability benefits of electrification. Transitioning to EVs yields immediate, quantifiable cost savings and carbon reductions, and with additional tailwinds from federal and state policies that begin going into effect in 2023, including new tax incentives for EVs, charging and more, 2023 will be a tipping point when the majority of commercial fleets begin or rapidly accelerate their electrification journey.

Joshua Aviv, Founder/CEO, SparkCharge

We will see the rise of electric fleets for passenger, autonomous and heavy-duty vehicles. We will also see mobile EV charging come to more cities.

Bill Cawein, Manager — Technology & Integration, Global Vehicles, FedEx Express

Electrification of commercial fleets goes nowhere without infrastructure to accompany it, so in 2023, I hope to see momentum around infrastructure development continue to grow. It is an incredibly complex and ever-evolving area, but with more professionals and utilities becoming familiar with design requirements and more funding available, I think infrastructure will command even more attention next year.

Daniel Weissland, President, Audi of America

The biggest trend for 2023 is action. The future is now and we will keep pushing toward our near-term goals like making all Audi production sites net carbon neutral by 2025 and launching only new all-electric models starting in 2026. Demand for BEV [battery electric vehicles] is high; we know our customers are ready and we’re all-in. In 2023 and beyond, the industry will also continue to focus on decarbonization across the full supply chain. At Audi, for example, all suppliers must undergo a sustainability ranking before they can be awarded a contract, and we require our battery cell manufacturers to use renewable energy sources for production.

Stacy Noblet, VP, Transportation Electrification & Senior Fellow, ICF Climate Center

In 2023, partnerships and collaboration will be key in breaking down barriers to increased transportation electrification, focusing on reliability, interoperability and equitable access. Between OEMs [original equipment manufacturers] teaming up with utilities, to productive interagency cooperation, everyone will be in each other’s business — in a good way!

Nate Springer, Vice President, Market Development Gladstein, Neandross & Associates

This will be the year that sustainability takes heavy transportation by storm. Customers, investors and regulators are now intent on decarbonizing transportation and leaders like Maersk, JB Hunt, UPS, FedEx, Schneider offer a beacon of possibility. In 2023, a wave of carriers will make bold sustainable transition plans that rely on proven and available renewable and near-zero technologies while testing a burgeoning market of zero-emission electric and hydrogen solutions.

Apoorv Bhargava, CEO of WeaveGrid

Even more EV Super Bowl ads than last year! But actually … I expect that utilities will play a more central role in enabling decarbonized transportation. But, there will continue to be concerns about the electric grid’s ability to handle rapid EV adoption and increased charging infrastructure deployment, particularly fueled by OEM investments in electrification and significant federal funding. Due to continued and new supply chain issues, utilities will need more software solutions to overcome distribution constraints in a way that is cost-effective for utility customers.

Maritime

Ingrid Irigoyen, Associate Director, Ocean and Climate, Aspen Institute Energy and Environment Program, The Aspen Institute

I predict that climate-leading companies that rely on ocean freight will become increasingly impatient with the slow pace of maritime transport decarbonization. I think they will put more pressure on carriers to reduce emissions now by operating more efficiently and will demand concrete plans from carriers that they are investing in a transition to new clean hydrogen-derived zero-emission fuels and offer zero-emission shipping services that are not yet currently available in the marketplace, but are widely recognized as the only viable pathway to Paris-aligned transoceanic shipping. I believe companies will be looking for new ways to collaborate and procure such green shipping services pre-competitively so that they can gain economies of scale and have greater collective impact than if they work alone.

Battery production and recycling

Ajay Kochhar, CEO/Co-founder, Li-Cycle

As more battery megafactories come online and as production ramps up, we expect manufacturing scrap to continue to increase, which is a core near-term feedstock for Li-Cycle’s environmentally friendly, safe and cost-effective recycling technologies. We also expect automakers will continue to focus on using recycled battery materials to support their production goals and qualify for clean vehicle tax credits from government initiatives such as the Inflation Reduction Act. Overall, the transition to clean energy and the EV revolution will continue to accelerate, and lithium-ion battery recycling will be an important driver by providing a greener and more cost-effective supply of battery materials.

Maciej Jastrzebski, CEO/co-founder, Li-Metal Corp

Li-Metal believes EV adoption will continue to accelerate into 2023 and we will see more vehicles on the road powered by batteries. Although we anticipate there will be more EVs on the road, in line with increases in lithium-ion battery prices, we expect they will be more expensive and North American automakers and battery developers will continue to explore more cost-effective solutions for battery production. We anticipate that continued efforts to commercialize new battery chemistries will result in concrete steps toward vehicles powered by next generation anodes on the roadways.

Bidirectional charging

Colin Gounden, President, VIA

We expect a dramatic rise in vehicle-to-building and vehicle-to-grid charging. With extreme weather, aging infrastructure and record supply chain shortages, the new generation of bidirectional electric vehicles will be a highly attractive source of energy flexibility for grid operators. Web3 technologies like zero-knowledge proofs will help verify that the electrons returning to the grid are from renewable sources while maintaining the privacy and anonymity of EV owners.

Get Charged Up for the Long Haul with Li-Metal’s Lithium Battery Tech

Li-Metal employee using roll-to-roll PVD equipment in Rochester, New York to produce anode materials for next-generation batteries

- Li-Metal Corp. (CSE: LIM) produces next-generation lithium for solid-state batteries

- Went public in Nov. 2021 in Canada, also trades in U.S. and Germany (OTC: LIMF, FSE: 5ZO)

- Makes high energy density lithium anodes which give EVs much more range, performance

- Next gen batteries don’t have flammable electrolytes, making them much safer

- Enterprise value of just C$42 million ($31 million), not reflecting massive opportunity

- Inked commercialization deal with Bolloré SE’s (Paris: BOL) Blue Solutions

- Blue Solutions is largest solid-state lithium battery maker, powers Mercedes-Benz’s eCitaro

- Expects commercialization in 2025, aligned with major OEM timelines

- Recently hired EV industry heavyweight Kunal Phalpher as President

- Currently producing anode material under “pilot” program in Rochester, NY

There’s an electric vehicle revolution underway that will continue for decades. Perhaps the most critical technology required will be batteries – and they need to get much more powerful to get the industry where it wants to be.

Investors keen to bet on next-generation batteries would be wise to consider Li-Metal Corp. (CSE: LIM), the brains behind the lithium components that make superior power storage possible. The company went public in Canada in November 2021 but the shares also trade in the U.S. (OTC: LIMF) and Germany (FSE: 5ZO).

The key to Li-Metal’s technology is a lithium-metal anode, which can offer superior energy density (meaning the storage capacity relative to mass) versus other materials such as graphite and silicon which have been used for many years. That means longer range or more room in EVs, but also a smaller footprint for stationary batteries or more cargo in electric ships.

Equally important is safety. Many next-generation battery designs eliminate flammable electrolytes, which means a dramatic reduction in the risk of fire or explosions. That is critical both for EVs and for new aircraft like eVTOLs which need to be extremely light and, of course, safe while in the air.

Li-Metal has also developed a specialized lithium metal production approach. It takes widely-available lithium carbonate through an environmentally-friendly process to create lithium metal at a far lower cost than other technologies allow. A traditional source – lithium chloride – creates five tons of chlorine gas for every ton of lithium units produced.

Li-Metal’s first lithium metal anode product produced at its facility in Rochester, NY

The move to lithium carbonate dramatically reduces capital expenditures and operating costs associated with cleaning up chlorine. Li-Metal can also derive source material from recycled battery components, another positive step to protect the environment and save costs.

All this appeals to original equipment manufacturers (OEMs) – especially because it translates to better margins. That’s critical in the current environment when competition is fierce while capital has also become scarce and expensive, putting OEMs under pressure to make rational cost decisions.

Indeed, the likes of BMW, General Motors, Rivian, Toyota and others have indicated publicly they plan to use solid state batteries. Li-Metals’ plans to commercialize in 2025 generally meet the launch timelines of such OEMs, positioning it well to be a supplier.

In a major sign of validation, Li-Metal has signed a development and commercialization deal with Bolloré SE’s (Paris: BOL) Blue Solutions, the largest commercial manufacturer of solid-state batteries. Blue Solutions provides Mercedes-Benz with batteries to power its eCitaro buses.

eCitaro Buses are Powered by Blue Solutions

Li-Metal is also in talks with many others. Those include 20 different battery and auto industry companies, of which 12 are sampling materials from Li-Metal.

The company has executed quickly, with sample materials in production at a “pilot” facility in Rochester, NY since January 2022. The facility can produce thousands of meters of lithium anode material annually for internal use or commercial customers.

Last year, Li-Metal produced more than 4,200 meters of sample lithium metal anode material versus 1,000 meters of sample material in 2021. Li-Metal also achieved 70% of commercial-scale production intensity targets. The company believes it operates the highest intensity lithium deposition process of its kind, beating all rivals in terms of efficiency.

The company has strong intellectual property protection in place to protect its lead over any rivals. Li-Metal made 17 patent filings in 2022, for a total of 33 patent applications in process.

A big recent hire was Kunal Phalpher as President a few months ago. Mr. Phalpher brings nearly two decades of global experience in the clean technology, battery materials and electric vehicle (EV) sectors, including his latest role as Chief Strategy Officer at Li-Cycle, a a leading lithium-ion battery recycler. He reports to Co-founder and CEO, Maciej Jastrzebski, another industry veteran with extensive experience in development, project engineering, IP protection and commercialization.

Turning to 2023, the company continues to support commercial partners with the provision of sample material with the aim of solidifying commercial production plans. Li-Metal expects to expand production capacity in the short term and eventually deploy anode production capacity at customer sites.

Li-Metal’s lithium metal pilot facility in Markham, Ontario

As the company approaches commercialization in the next couple of years, there’s likely scope to find partners who can help fund some production expenses. That would allow Li-Metal to remain capital light and avoid any strains on its balance sheet.

Savvy investors should see serious value in Li-Metal shares. The company has an enterprise valuation, adjusted for cash, of C$42 million ($31 million). That looks low compared with the tens of billions in industrywide solid state battery sales that should come in just a few years. Indeed, other players command lofty valuations, including QuantumScape Corp. at 16 times 2026 sales, according to Sentieo, an AI-enabled research platform.

In the current market, there are countless ways to invest in electrification. But with proprietary technology, seasoned leadership and a head start over rivals, investors should see the luster in Li-Metal.

Contact:

IPO Edge

www.IPO-Edge.com

Editor@IPO-Edge.com